Wednesday, September 7, 2022

As part of its annual Get Smart About Credit campaign, the American Bankers Association (ABA) Foundation is providing consumers with information on common scholarship and student loan scams and tips on how to avoid falling victim.

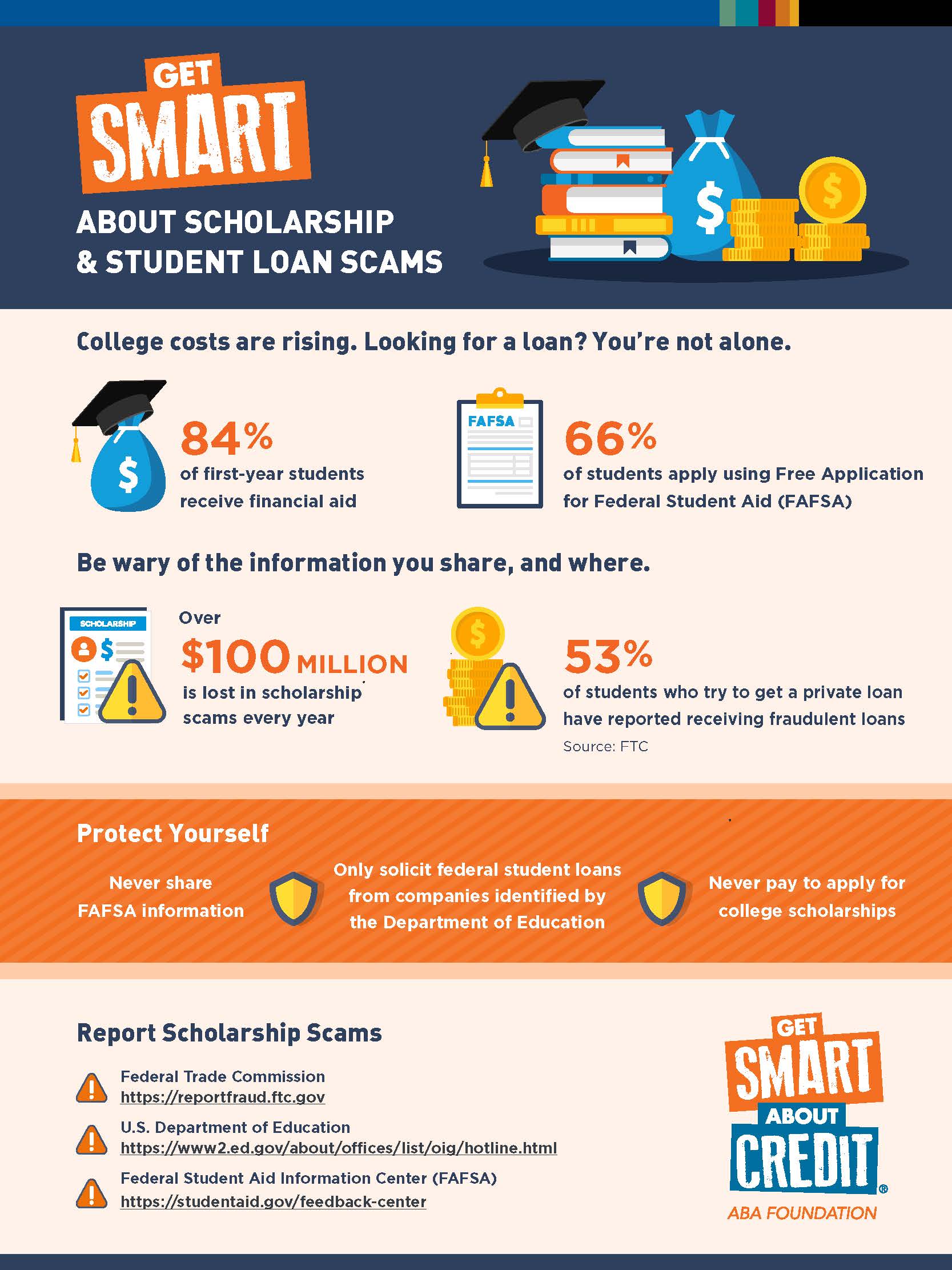

With college costs on the rise, many students are in search of scholarships and federal student loans to help them pay for their education. The ABA reports that 84% of first-year students receive financial aid and 66% apply using Free Application for Student Aid (FAFSA).

Unfortunately, the high volume of scholarship and student loan applications also creates an opportunity for scam artists. More than $100 million is lost in scholarship scams every year and more than half of all students who applied for a private loan reported receiving a fraudulent loan, according to the FTC.

“We think it’s critically important to help spread the word on the prevalence of these scams and what students and parents can do to protect themselves during the application process,” said Lindsay Torrico, executive director of the ABA Foundation. “With the Biden administration’s recent decision to offer student debt relief to millions of borrowers, we want consumers to be particularly vigilant and informed as they navigate the new forgiveness program. Paying for college is challenging enough without losing money to these bad actors.”

The ABA Foundation offers three quick tips for how to stay safe while applying for scholarships and student loans:

- Never share FAFSA information.

- Only solicit loans from companies identified by the Department of Education.

- Never pay to apply for college scholarships.

If you or your family encounter suspected scholarship scams, report them immediately to the following government agencies:

- Federal Trade Commission

- U.S. Department of Education

- Federal Student Aid Information Center (FAFSA)

About the American Bankers Association

The American Bankers Association is the voice of the nation’s $24 trillion banking industry, which is composed of small, regional and large banks that together employ more than 2 million people, safeguard $19.9 trillion in deposits and extend $11.4 trillion in loans.

About the ABA Foundation

Through its leadership, partnerships, and national programs, ABA’s Community Engagement Foundation (dba ABA Foundation), a 501(c)3, helps bankers provide financial education to individuals at every age, elevate issues around affordable housing and community development, and achieve corporate social responsibility objectives to improve the well-being of their customers and their communities.